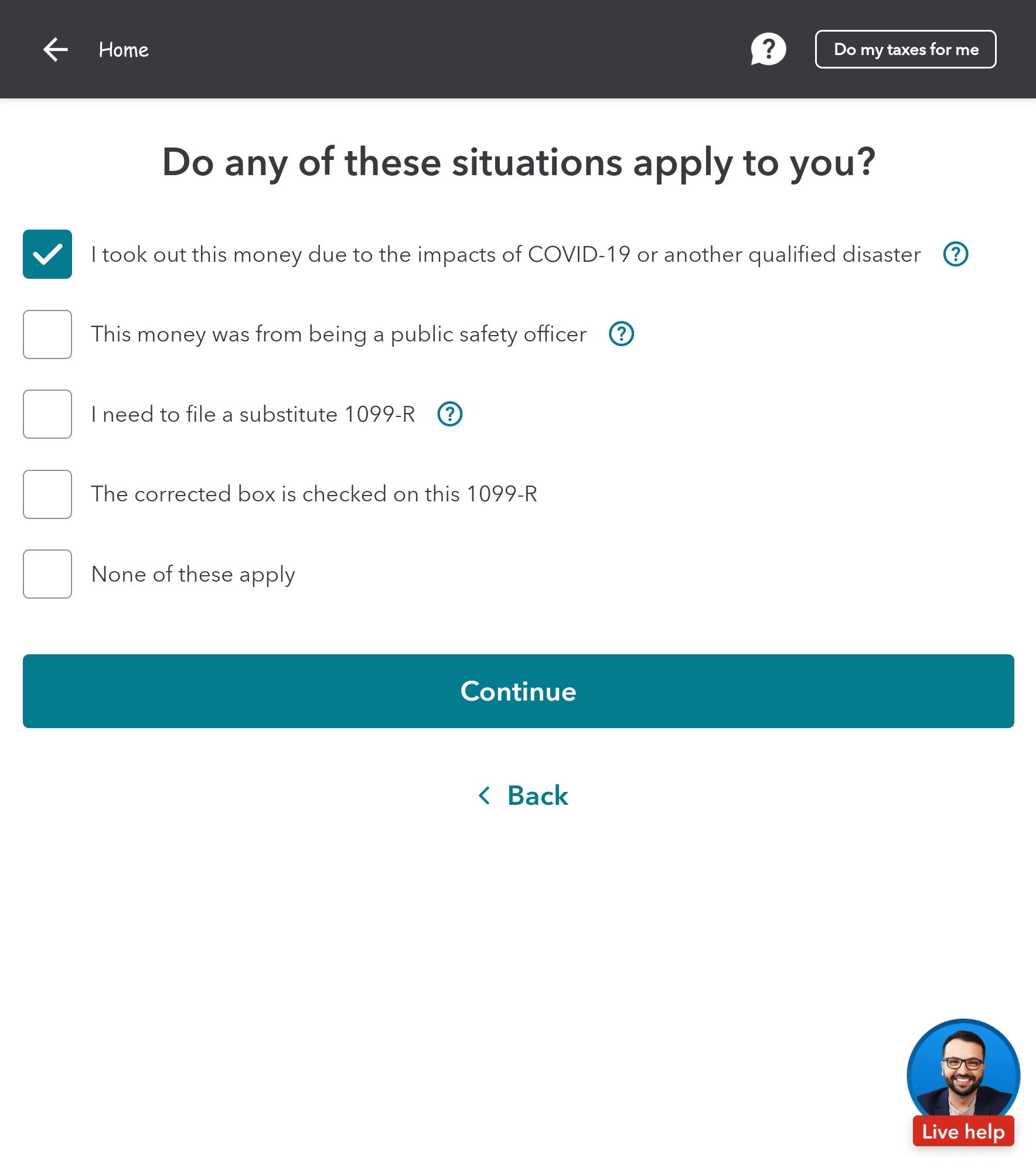

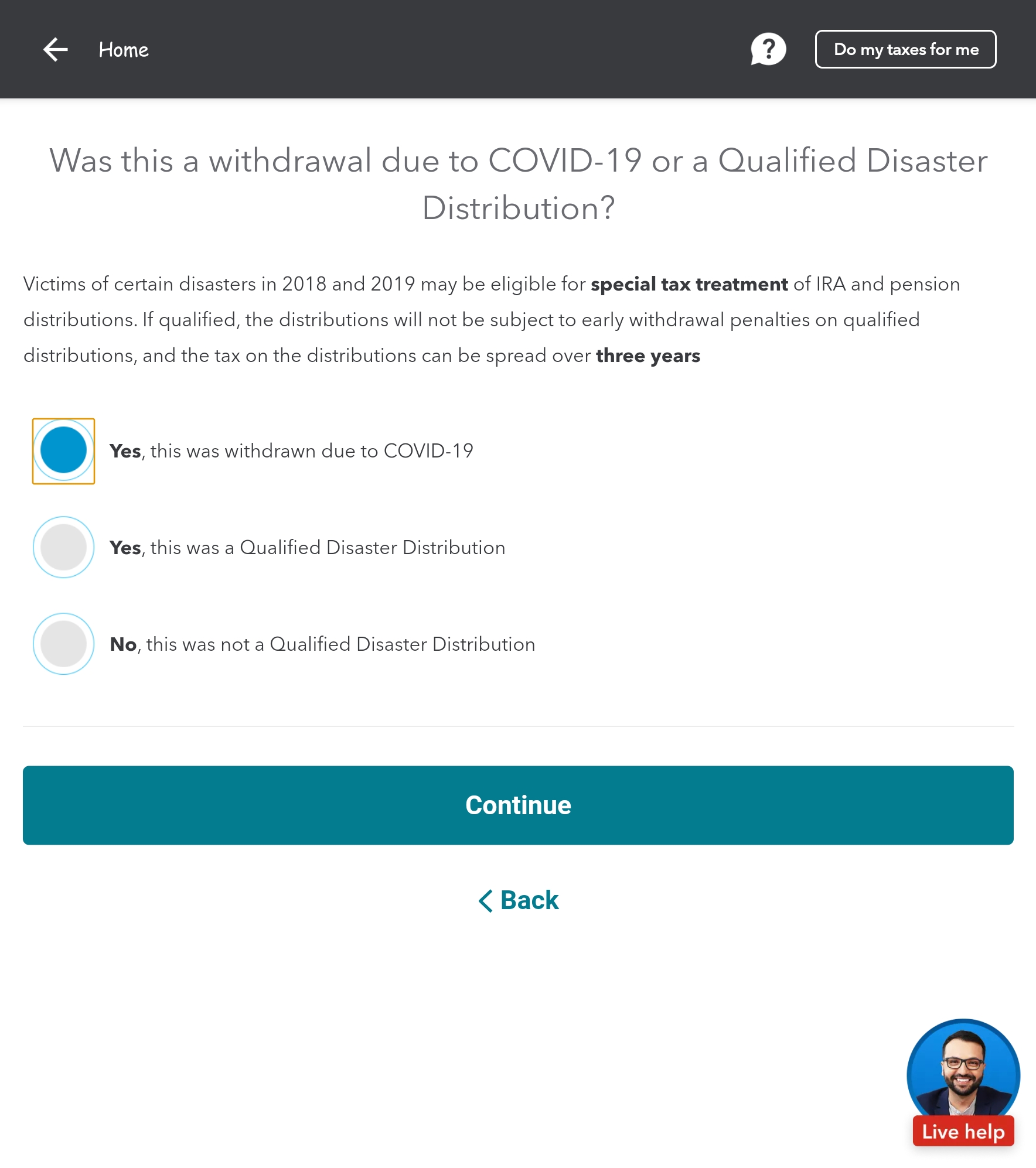

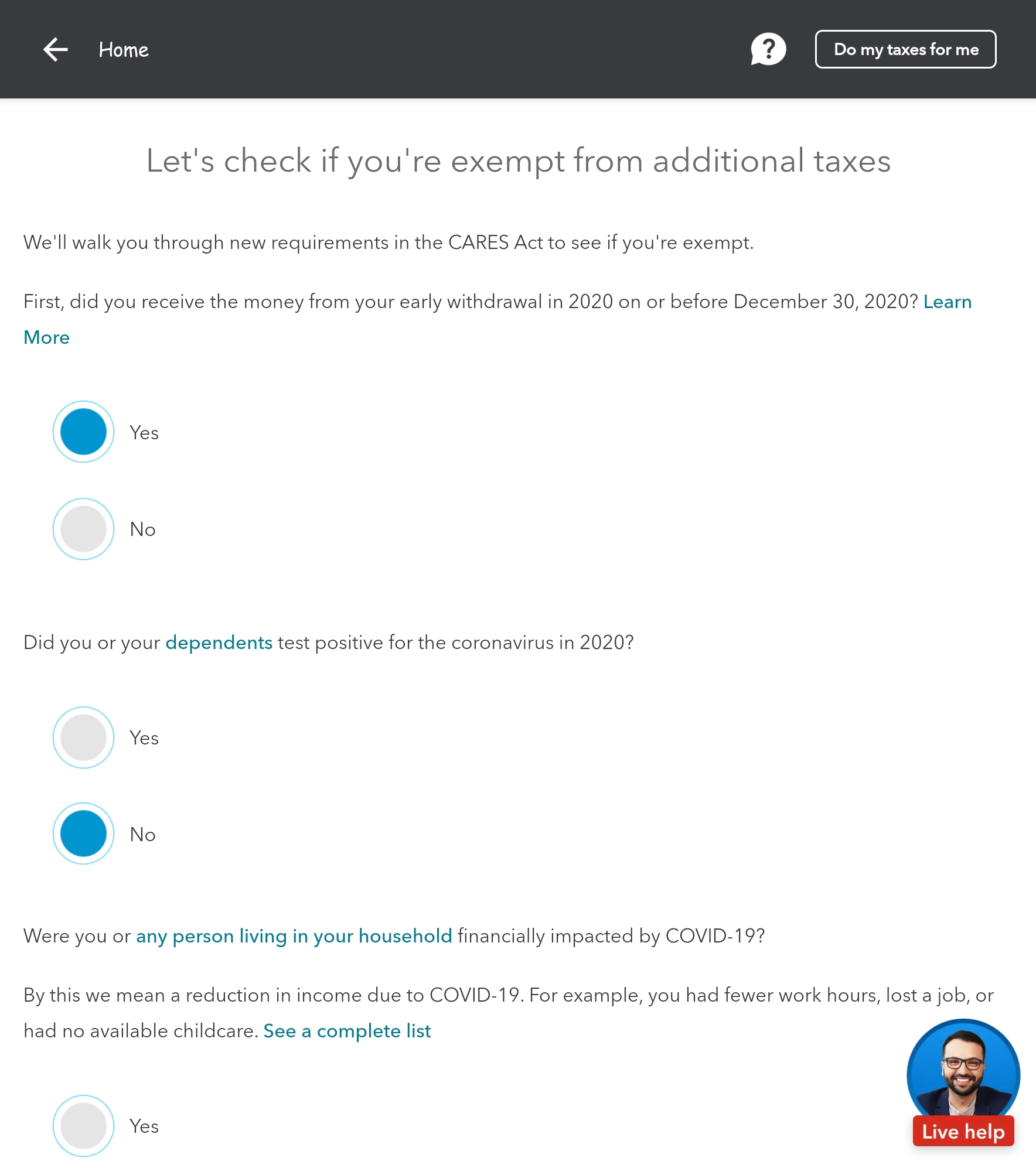

My problem is that i also want to amend. Webthe form was scheduled to be available on turbotax on march 24, 2022. You can file it if any of the three cases apply to you. One is if you have received the qualified disaster. Webthe remaining 55% of the distribution is taxable on your 2021 and 2022 tax returns (21 2/3% on your 2021 tax return and 33 1/3% on your 2022 tax return). Any distributions you took within the 2021 tax year will be taxable on your federal return. This will also include any coronavirus. • qualified 2021 and later disaster distributions, if any; • qualified 2020 disaster distributions made.

Related Posts

Recent Post

- Airbnb In West Palm Beach Florida

- Busted Mugshots Wilmington Nc

- Mark Baden Salary

- Feet Sniffing And Worship

- Busted Newspaper Oconee Sc

- Student Doctor Network 2023

- Leo Horoscope Vice Daily

- Zillow Homes For Sale California

- African American Blessing Quotes

- Jobs Hiring With Weekends Off

- Facebook Marketplacefacebook Marketplace

- Walmart Oil Change Synthetic Oil

- Altoona Mirror Obituaries Altoona Pennsylvania

- The Georgia Gazette

- Kauai Electric Outage

Trending Keywords

Recent Search

- Craigslist Jobs Stamford Ct

- Chita Craft Husband

- Facebookmarketplaceboise

- Citrix Wakemed

- How To Use Dollar General Digital Coupons

- Nh School Cancellations

- Wicked Local Plymouth

- Downdetector Att

- Pumps Lowes

- Chicago Tribune Daily Jumble

- Interneychicks

- Litchfield Mn Obituary

- Reddit Electricians

- Marysville Mi Zillow

- Accident Hanover

![Turbotax Home & Business + State 2022 [PC/Mac Download] - Walmart.com Turbotax Home & Business + State 2022 [PC/Mac Download] - Walmart.com](https://i5.walmartimages.com/asr/032f1e12-76c5-40c6-8f7d-bda59d295ffe.9eb91de9c81830aa662be4b3dd981a3d.jpeg)

.jpeg)

![Sold: TurboTax 2022 Deluxe | [H]ard|Forum Sold: TurboTax 2022 Deluxe | [H]ard|Forum](https://cdn.hardforum.com/data/attachment-files/2023/03/832223_PXL_20230331_024910967.jpg)