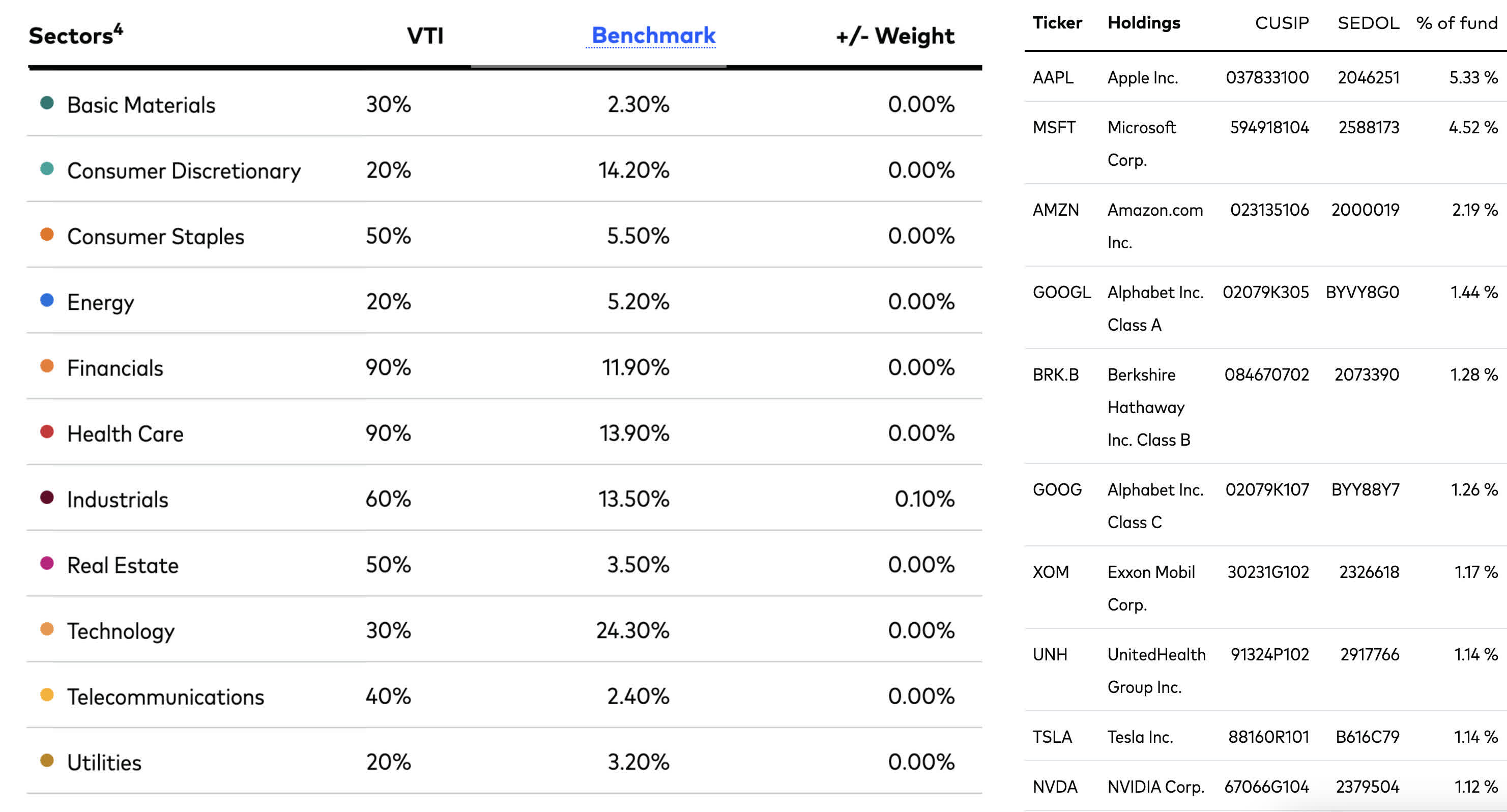

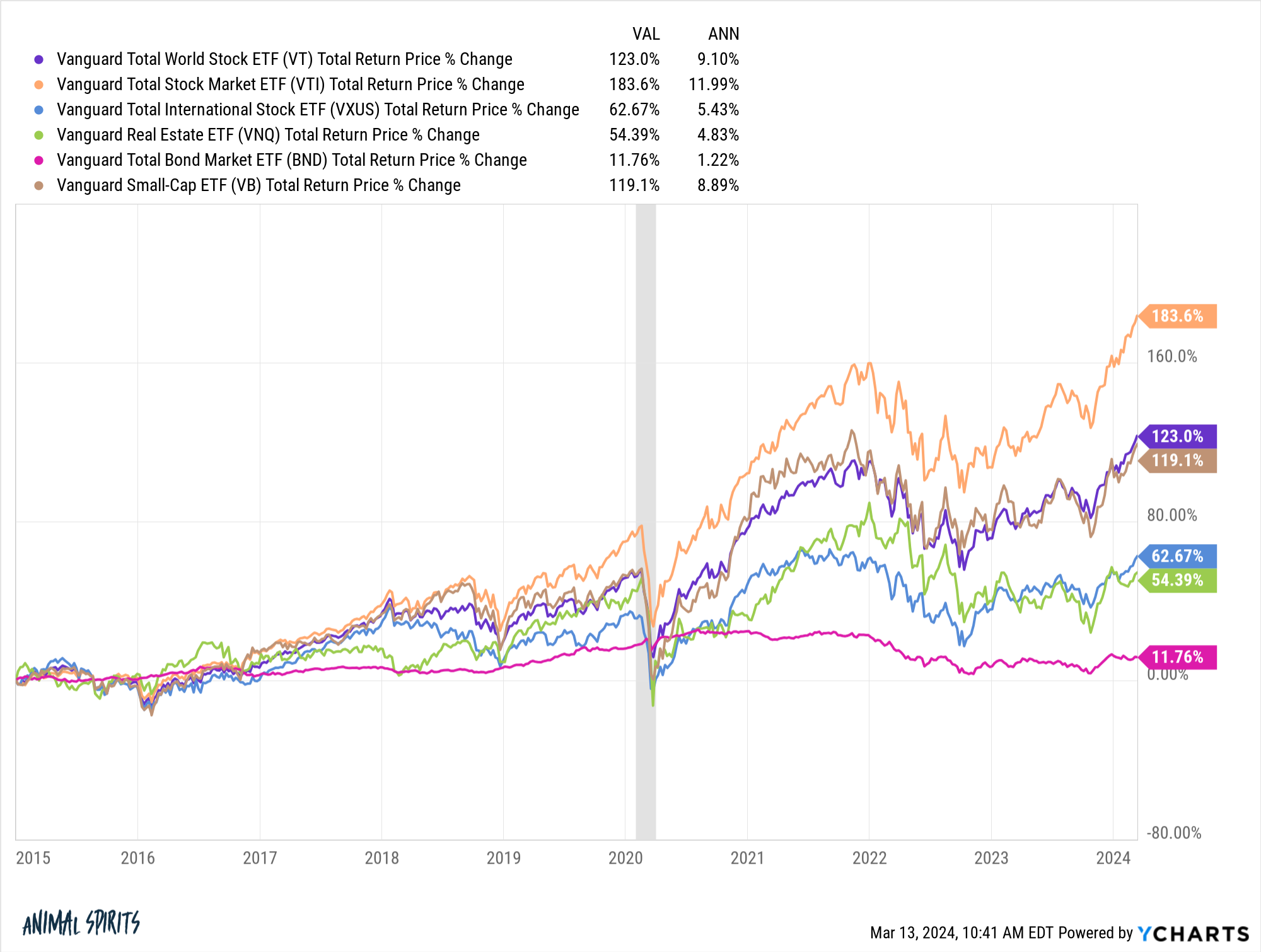

Webthe most ideal thing is to rebalance vti/vxus. If you have 100m nw then it saves you a lot. If you’re Point is there is no wrong. Weboct 4, 2024 · compare and contrast key facts about vanguard total stock market etf (vti) and vanguard total international stock etf (vxus). Vti and vxus are both. It compares fees, performance, dividend yield, holdings, technical indicators, and many other metrics that. Webfrom a financial standpoint, vti + vxus > vt only if you allocate / rebalance properly. While you can do better due to the slightly lower fees, human emotion / error in the. Webassuming a market weight equity portfolio, if you hold vtsax+vxus instead of vt then 40% of your equity would be vxus, so the value of the ftc would be 0. 09% (0. 23 * 40%) or greater than the entire expense ratio. Webcompare vti and vxus etfs on current and historical performance, aum, flows, holdings, costs, esg ratings, and many other metrics.

Related Posts

Recent Post

- Job Monster

- California Roster Of Handguns

- Plasma Bentonville Ar

- Youtube Healing Meditation

- Molina Apple Health Find A Provider

- Pilot Flying J Jobs Near Me

- Alachua County Jail Inmate Lookup

- Value City Appliances

- Yelp Spam Comment Remover Job

- Plasma Donation Altamonte Springs

- Myuhccommunity Planotc

- Sagittarius Horoscope Vogue India

- Knoxville Jail 24 Hour Arrest

- Does Mercari Take Paypal

- Etsy Painting Of House

Trending Keywords

Recent Search

- You Are Out On The Water In Foggy Conditions Quizlet

- Billy Hoskinson And Molly

- Indeed Driver Jobs Near Me

- Brian Niznansky

- Cvs Covid Vaccine Records

- Martin Castille Funeral Home Obits

- Publix Jobs West Palm Beach

- Netspend Add Cash

- Who Has Hot Route Master Madden 24

- Liberty University Online Cost

- Michael Rosenbaum Imdb

- Apply Heb Jobs

- Boat Values Kelley Blue Book

- Amazon Careers Schertz

- Plain Dealer Obituary

_14.jpg)