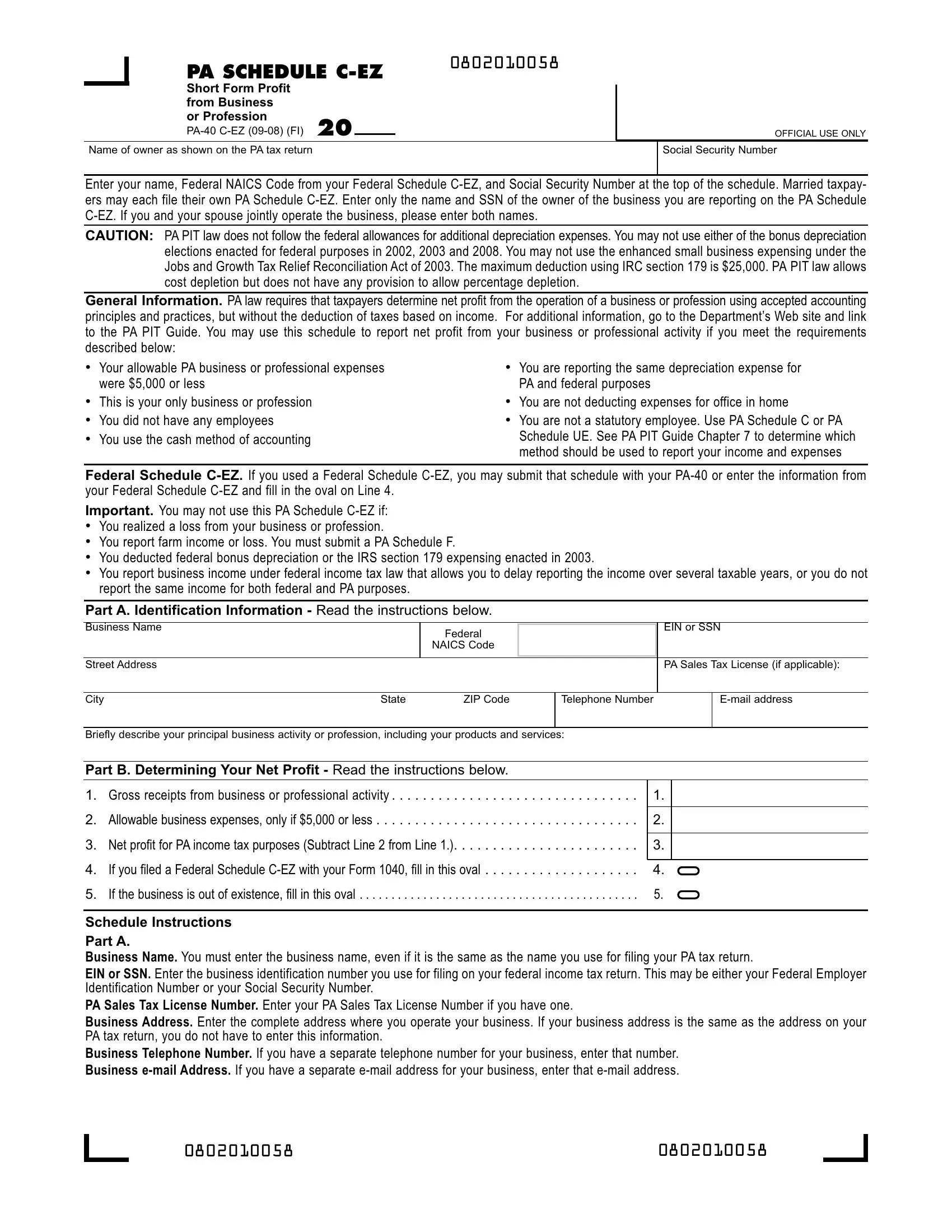

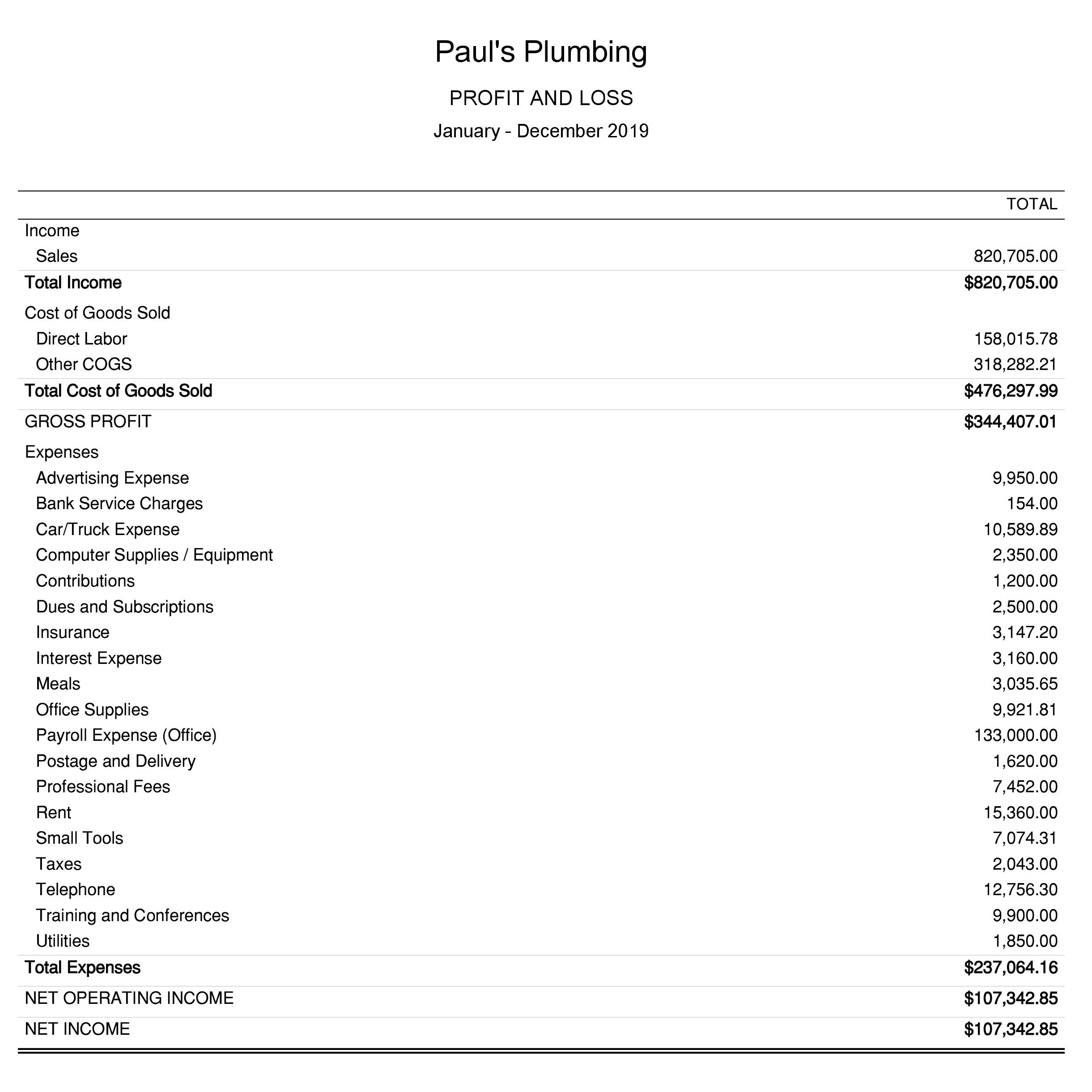

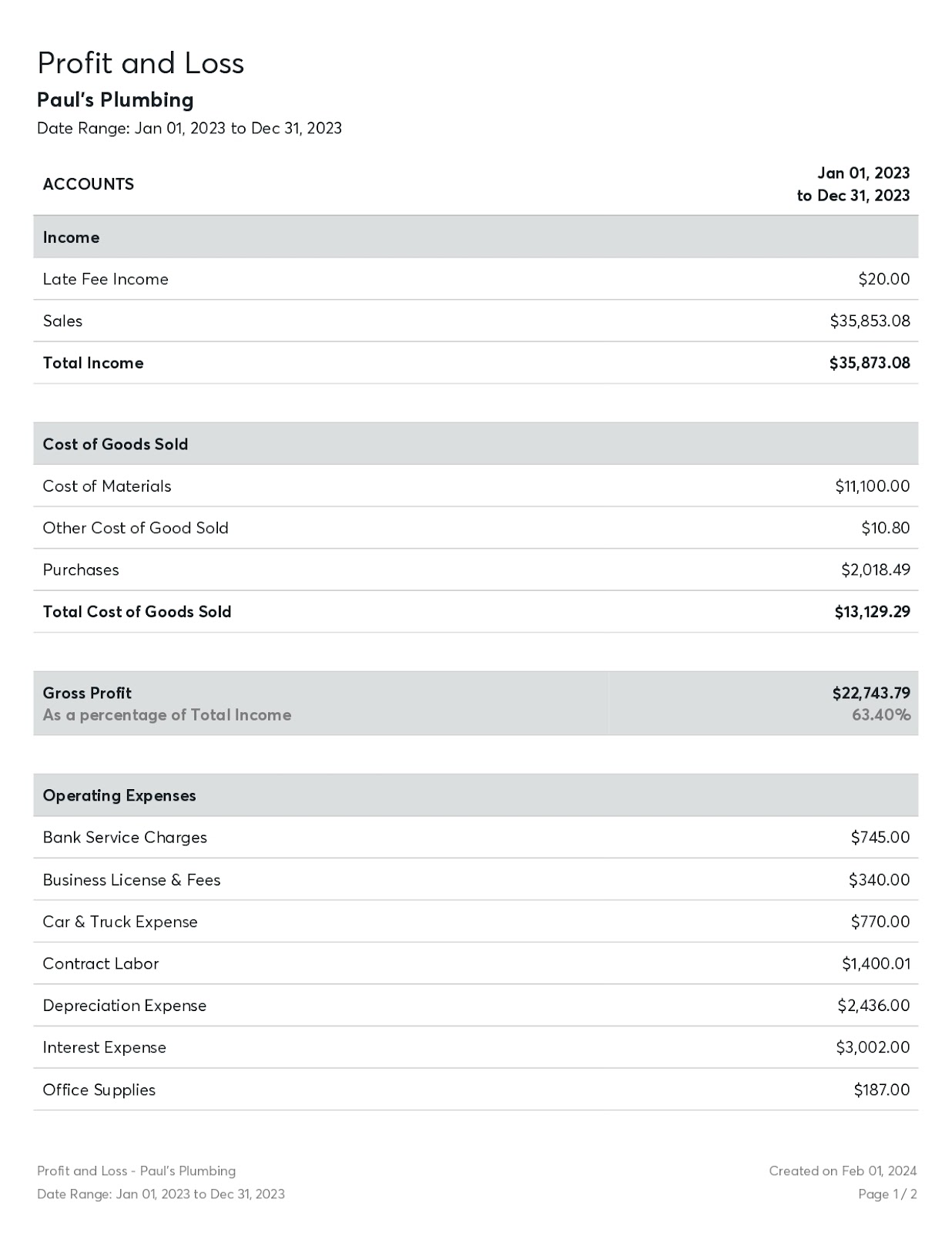

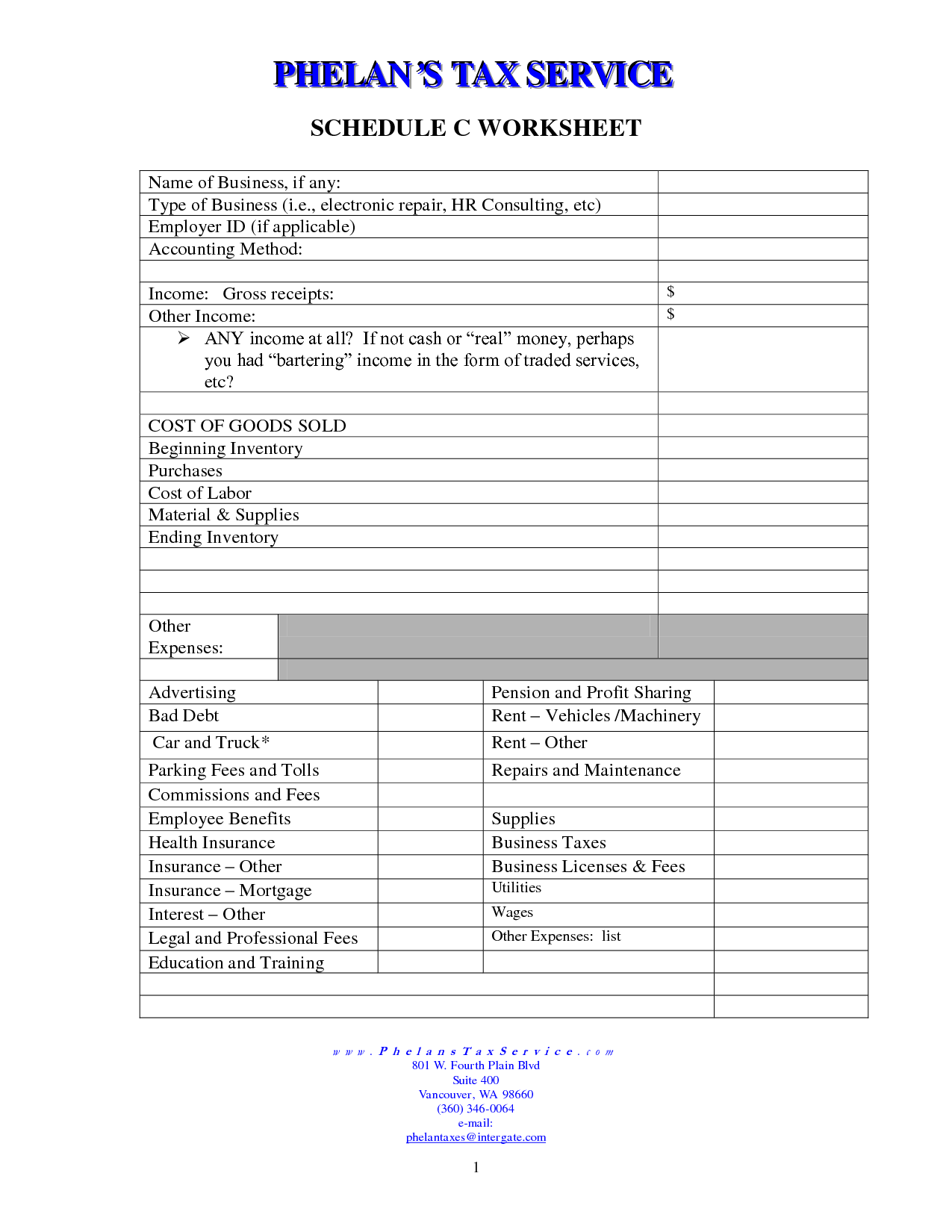

Websep 19, 2022 · schedule c is the linchpin of your independent contractor taxes. It's the form that lets you claim business expenses regardless of whether you itemize your tax. Webfilling out schedule c for your doordash business is a relatively straightforward process. Here are the key sections and questions you need to pay attention to: Webfilling out a schedule c is one of the most effective ways for doordash contractors to pay only what they owe in taxes. Documenting their business income and expenses ensures. If you want to deduct expenses related to your income then you will need. Webuse schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if your.

Related Posts

Recent Post

- San Bernardino Superior Court Open Access

- Irish Spring And Bugs

- Cody Detwiler Arrest

- Total Boat Epoxy Calculator

- Ace Hardware Gray Maine

- Weed Eater Blades Lowes

- Usc Admitted Students Day

- Gulstan Dart Born

- Dte Power Outage Area

- Cedar Park Power Outage

- Indeed Reno Sparks Nv

- Woman Killed In Buckhead Home

- Rep Athena Vs Ares

- Female Transformation Spell

- 10x30 Tiny House Floor Plans

Trending Keywords

Recent Search

- Obituary Hickory Daily Record

- Wbli Contest

- Midwest Shooting Supply Hiawatha

- Junior High State Wrestling Ohio

- Krissy Tipton Obituary

- Gore Site List

- Kcso 24 Hr Arrest List

- Sams Club Storage Sheds

- English Bulldog Puppies For Sale In Va Under 500

- Borland Groover Physicians

- Chemistry Test

- Ppp Detective Illinois

- Ibew 760 Jobs

- Submit Music Free

- Kern County Arrest Log

/GettyImages-174038203-5a4d1e6de258f80036c28e70.jpg)

:max_bytes(150000):strip_icc()/ScheduleD2022IRS-11353a1e824e41a9a83f83e39fd0f879.jpg)

:max_bytes(150000):strip_icc()/ScheduleC-ProfitorLossfromBusiness-1-2b9fe42e669342c783bbaae69e570415.png)